Safeguard Your Home and Loved Ones With Affordable Home Insurance Plans

Significance of Affordable Home Insurance

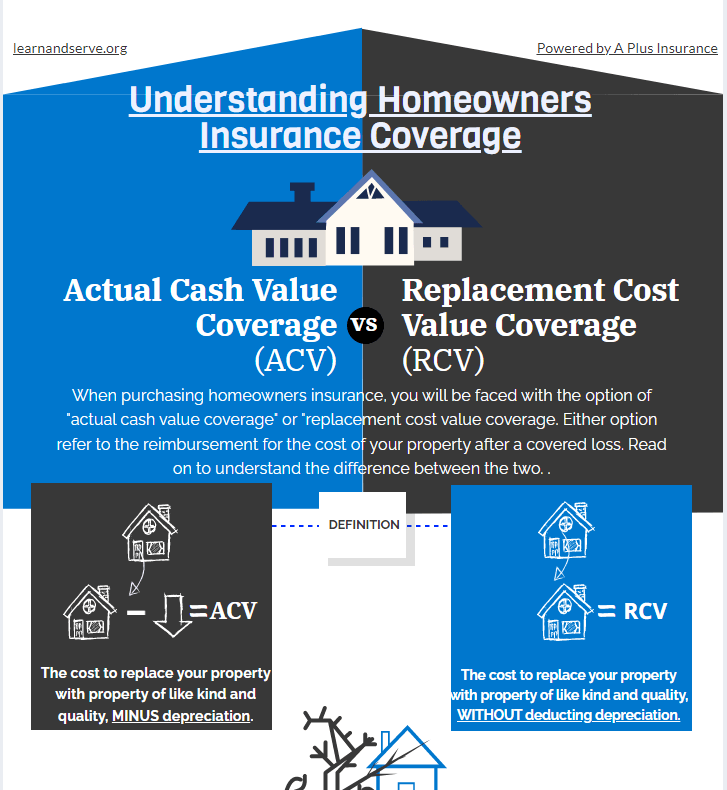

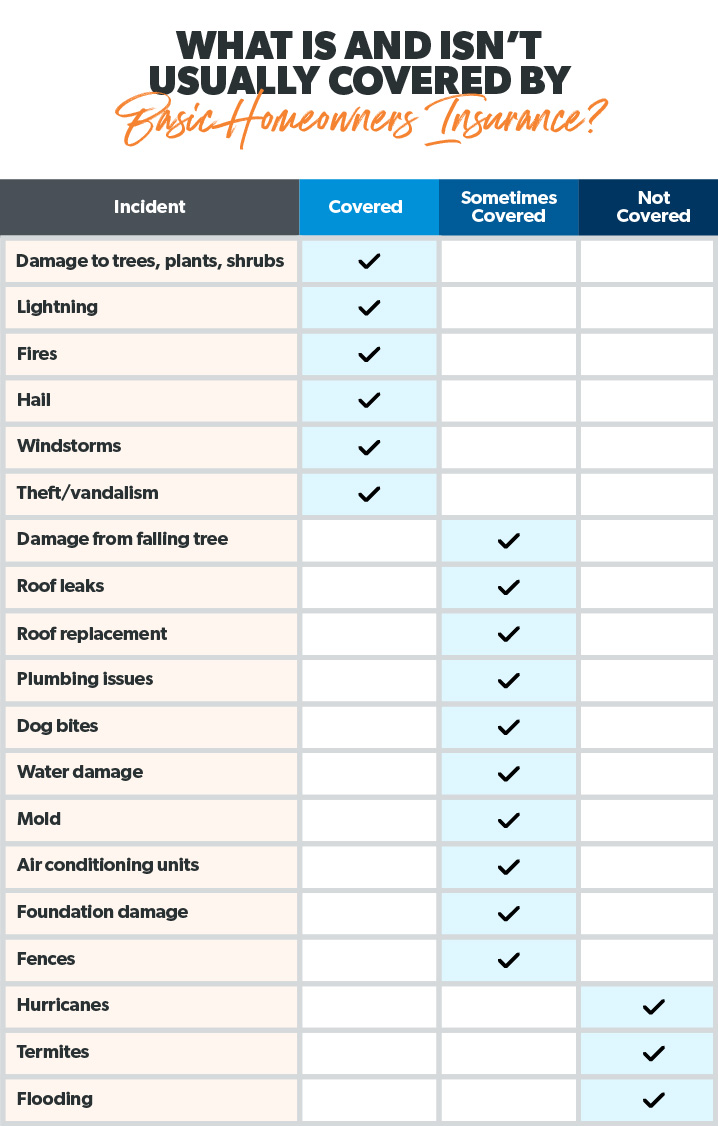

Securing inexpensive home insurance is critical for guarding one's property and economic health. Home insurance coverage supplies protection against numerous risks such as fire, theft, natural catastrophes, and individual responsibility. By having a comprehensive insurance policy plan in area, property owners can feel confident that their most considerable financial investment is safeguarded in case of unexpected scenarios.

Affordable home insurance not just gives financial protection yet likewise offers assurance (San Diego Home Insurance). Despite increasing property values and construction costs, having an economical insurance coverage ensures that home owners can easily restore or fix their homes without dealing with considerable economic concerns

Moreover, budget friendly home insurance policy can likewise cover personal items within the home, using compensation for products damaged or stolen. This protection extends past the physical structure of the house, protecting the materials that make a residence a home.

Protection Options and Boundaries

When it involves coverage limitations, it's essential to comprehend the optimum amount your plan will pay out for every kind of protection. These restrictions can vary depending upon the policy and insurance provider, so it's vital to evaluate them carefully to ensure you have sufficient security for your home and possessions. By comprehending the protection choices and limitations of your home insurance coverage plan, you can make enlightened decisions to protect your home and loved ones efficiently.

Elements Affecting Insurance Coverage Expenses

A number of variables substantially affect the expenses of home insurance coverage. The location of your home plays a vital duty in establishing the insurance policy costs. Houses in locations susceptible to natural calamities or with high crime rates typically have higher insurance prices because of raised risks. The age and problem of your home are also factors that insurance providers think about. Older homes or homes in inadequate condition may be a lot more pricey to guarantee as they are much more vulnerable to damages.

In addition, the sort of coverage you pick straight affects the cost of your insurance plan. Choosing for extra protection choices such as flooding insurance or quake insurance coverage will certainly boost your premium. In a similar way, picking higher coverage restrictions will certainly lead to higher costs. Your deductible amount can also influence your insurance expenses. A greater insurance deductible typically indicates lower premiums, however you will certainly have to pay more out of pocket in the event of a case.

Furthermore, your credit rating, claims history, and the insurance coverage firm you pick can all affect the rate of your home insurance plan. By considering these elements, you can make informed choices to help manage your insurance coverage sets you back efficiently.

Contrasting Quotes and Suppliers

In addition to contrasting quotes, it is critical to evaluate the track record and monetary security of the insurance policy service providers. Try to find consumer reviews, rankings from independent firms, and any history of problems or governing actions. A trusted insurance supplier need to have a great track record of immediately processing insurance claims and offering exceptional client service.

Moreover, think about the particular coverage features offered by each copyright. Some insurance firms might offer fringe benefits such as identity theft security, tools failure insurance coverage, or insurance coverage for high-value things. By meticulously comparing quotes and providers, you can make an educated choice and choose the home insurance plan that ideal meets view it your demands.

Tips for Conserving on Home Insurance Policy

After thoroughly comparing quotes and providers to locate the most ideal coverage for your demands and spending plan, it is sensible to discover efficient approaches for conserving on home insurance coverage. Numerous insurance coverage companies supply discounts if you acquire multiple plans from them, such as combining your home and automobile insurance. Routinely assessing and updating your plan to show any kind of adjustments in your home or situations can guarantee you are not paying for insurance coverage you no longer requirement, aiding you conserve money on your home insurance coverage premiums.

Final Thought

Finally, protecting your home and loved ones with affordable home insurance is essential. Understanding insurance coverage options, variables, and limits affecting insurance prices can aid you make informed choices. By comparing companies and quotes, you can locate the best policy that fits your requirements and spending plan. Implementing pointers for saving money on home insurance policy can additionally assist you protect the needed security for your home without damaging the financial institution.

By unwinding the details of home insurance policy strategies and exploring practical strategies for safeguarding cost effective coverage, you can guarantee that your home and loved ones are well-protected.

Home insurance policy plans normally use a number of coverage alternatives to secure your home and items - San Diego Home Insurance. By recognizing the protection options and restrictions of your home insurance plan, you can make enlightened choices to protect your home and loved ones resource effectively

Routinely assessing and upgrading your plan to show any modifications in your home or conditions can ensure you are not paying for insurance coverage you no longer requirement, helping you conserve money on your home insurance premiums.

In verdict, securing your home and loved ones with budget-friendly home insurance is critical.